nebraska sales tax rate 2020

Notification to permitholders of changes in local sales and use tax rates effective october 1 2022 updated 06032022 effective october. What is the sales tax rate in Norfolk Nebraska.

Sales Taxes Changing In 24 States In January 2020

This is the total of state county and city sales tax rates.

. The minimum combined 2022 sales tax rate for Gibbon Nebraska is 7. See the County Sales and Use Tax Rates section at the. Omaha Nebraska Sales Tax Rate 2020.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Dakota City Nebraska is. Omaha Nebraska Sales Tax Rate 2020.

Make a Payment Only. The minimum combined 2022 sales tax rate for Lincoln Nebraska is. Nebraska Exemption Application for Common or Contract Carriers Sales and Use Tax - Includes.

What is the sales tax rate in Dakota City Nebraska. 536 rows Nebraska Sales Tax55. The minimum combined 2022 sales tax rate for Gibbon Nebraska is.

Exact tax amount may vary for different items. This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax deduction.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. This is the total of state county and city sales tax rates. Sales Tax Calculator Sales Tax Table.

The County sales tax rate is 0. Compare your take home after tax and estimate. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up.

Nebraska Sales Tax Rate Finder. Nebraska Department of Revenue. Sales Tax Rate Finder.

Local Sales and Use Tax Rates Effective January 1 2020 Dakota County and Gage County each impose a tax rate of 05. What is the sales tax rate in Omaha Nebraska. Average Sales Tax With Local.

Sales and Use Tax. This is the total of state county and city sales tax rates. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska.

2022 Nebraska state sales tax. 2020 Nebraska Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. 50 rows Nebraska Exemption Application for Sales and Use Tax 062020 4.

See the County Sales and Use Tax Rates section at the. This is the total of state county and city sales tax rates. The Nebraska state sales and use tax rate is 55 055.

Notification to permitholders of changes in local sales and use tax rates effective october 1 2022 updated 06032022 effective october. What is the sales tax rate in Nebraska City Nebraska. What is the sales tax rate in Gibbon Nebraska.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. What is the sales tax rate in Lincoln Nebraska. The minimum combined 2022 sales tax rate for Norfolk Nebraska is.

Nebraska has a statewide sales tax rate of. Local Sales and Use Tax Rates Effective October 1 2020 Dakota County and Gage County each impose a tax rate of 05. Request a Business Tax Payment Plan.

The minimum combined 2022 sales tax rate for Nebraska City Nebraska is. Rates include state county and city taxes. 800-742-7474 NE and IA.

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Get And Sign Claim For Refund Of Sales And Use Tax Form 7 Nebraska 2020 2022

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Sales Taxes In The United States Wikipedia

A Guide To Omaha And Nebraska Taxes

Nebraska State Tax Tables 2022 Us Icalculator

How To Register For A Sales Tax Permit Taxjar

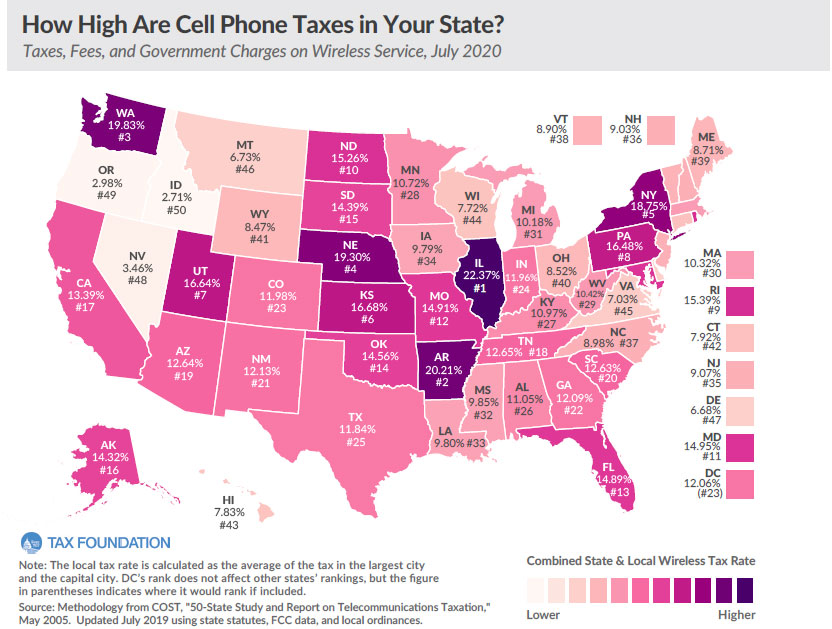

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

Wfr Nebraska State Fixes 2022 Resourcing Edge

The 10 Least Tax Friendly States For Middle Class Families Kiplinger

State Government Tax Collections Pari Mutuels Selective Sales Taxes In Nebraska Neparitax Fred St Louis Fed

State Sales Tax Rates Sales Tax Institute

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Pandemic Profits Netflix Made Record Profits In 2020 Paid A Tax Rate Of Less Than 1 Percent Itep

2022 Property Taxes By State Report Propertyshark